Partnership Aimed at Expanding Access to Finance for Small and Medium Businesses Across the Globe

WASHINGTON, D.C., and TORONTO, February 28, 2023 – Uplinq, the first global credit assessment and scoring platform for SMB lenders, today announced a partnership with the SME Finance Forum, a global network aimed at expanding finance to small and medium businesses (SMEs). The SME Finance Forum was established by the G20 Global Partnership for Financial Inclusion and is managed by the International Finance Corporation (IFC), a part of the World Bank Group.

“Since 2016, we’ve been implementing our mission to build a global membership to support better SME financing, and we’ve established a network with over 240 active member institutions, which operate in over 190 countries. We are delighted to welcome Uplinq to further grow our mission of helping underserved small enterprises.” said Matthew Gamser, CEO of the SME Finance Forum.

Following the 2010 G20 Summit in Seoul, the Global Partnership for Financial Inclusion (GPFI) – which includes all G20 countries, interested non-G20 countries, and other relevant stakeholders – launched the SME Finance Forum to expand financial inclusion and accelerate access to finance for the 200 million global businesses that need it to invest, grow, and create new jobs. To advance this goal, the SME Finance Forum unites financial institutions, technology companies, and international development institutions to share knowledge, foster innovation, spur policy changes, and build connections that will promote the growth of SMEs.

"We are proud to partner with the SME Finance Forum to improve financial inclusion and expand access to finance for SMEs across the globe,” said Patrick Reily, co-founder of Uplinq. “We are confident that our breakthrough technology will allow lenders in every region to improve and expand their lending decisions and get more cash into the hands of the entrepreneurs, who are the backbone of the global economy.”

Prior to co-founding Uplinq, Reily held leadership positions with leading banks and financial institutions. He has contributed to several World Bank Group and G20 initiative on economic growth and is the recipient of the Malcolm Baldrige Award, the highest presidential honor for performance excellence in the U.S.

In partnership with the SME Finance Forum, Uplinq will host a webinar on financial inclusion on April 19, 2023 and co-publish additional educational materials on the subject.

About SME Finance Forum

The SME Finance Forum was established by the G20 Global Partnership for Financial Inclusion (GPFI) in 2012 as a knowledge center for data, research, and best practice in promoting SME finance. As an implementing partner for the GPFI, the International Finance Corporation (IFC) was tasked with managing the initiative. The Forum operates a global membership network of +240 members that brings together financial institutions, technology companies, and development finance institutions to share knowledge, spur innovation, and promote the growth of SMEs.

To see all SME Finance Forum members, please visit: https://www.smefinanceforum.org/members/member-list

About Uplinq

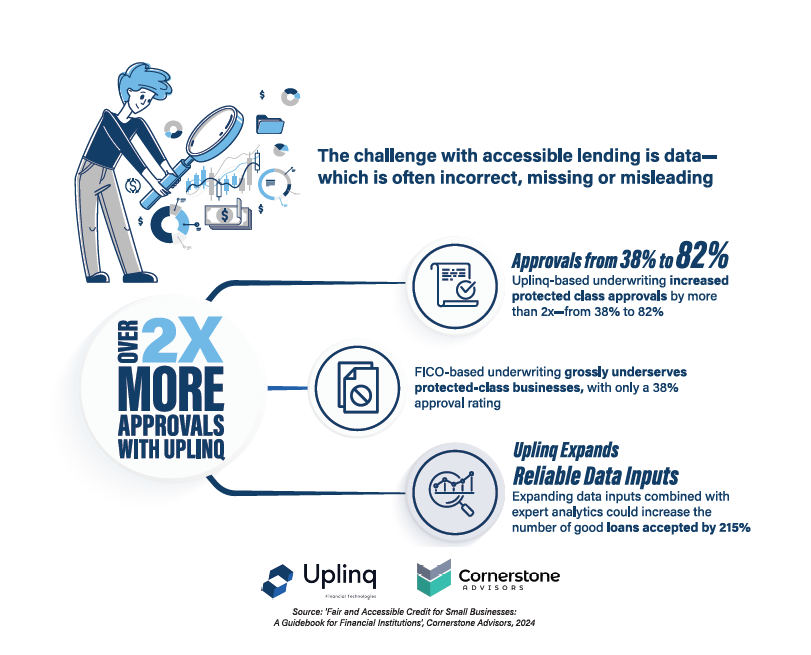

As the first global credit & scoring assessment platform for small business lenders, Uplinq is a purpose driven company with a mission to help small business owners gain access to fair and ethical credit, while enhancing SMB lending practices for all lenders globally. Uplinq's breakthrough technology empowers lenders to approve and manage risks on loans they would have otherwise declined based on traditional loan underwriting criteria, while incorporating environmental, market & community data to better understand the specific loan applicant. Its technology has served as a foundation for more than $1.4 Trillion in underwritten loans.

Learn more about Uplinq at uplinq.co and connect with them on LinkedIn or Twitter.