External Resources

Digital Financial Services

Nov 14, 2024

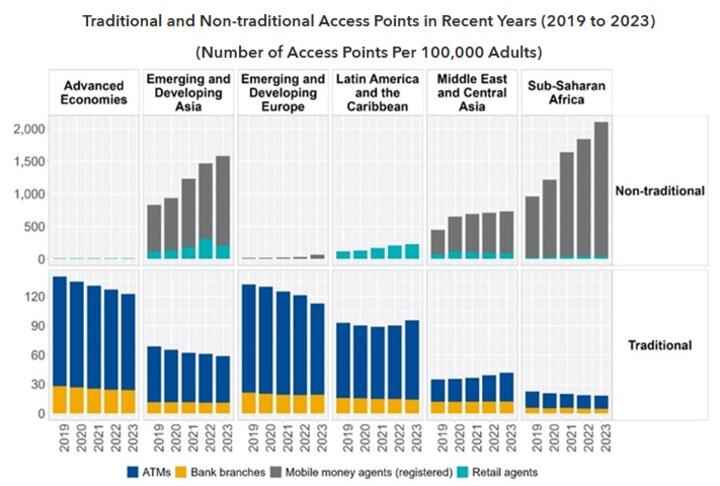

IMF Releases the 2024 Financial Access Survey Results October 30, 2024 Washington, DC: The International Monetary Fund (IMF) released the results of the 2024 Financial Access Survey (FAS), marking the 15th anniversary of the FAS. The report “FAS: 2024 Highlights,” published along with the data release, summarizes the key trends on access to and...

Trade Finance

Policy & Regulation

Oct 08, 2024

Business Ready (B-READY) 2024 report assesses the regulatory framework and public services directed at firms, and the efficiency with which regulatory framework and public services are combined in practice.

Non Financial Services

Supply & Value Chain Finance

Payments

May 25, 2018

Nielsen and Alipay jointly issued the 2017 Survey: Outbound Chinese Tourism and Consumption Trends, which details how Chinese tourists pay for products in services and their behaviors in making such decisions. Ninety-nine percent of Chinese respondents have the Alipay app installed on their phones. The survey found that discounts and payment...

Non Financial Services

Sustainable Finance

Jan 05, 2018

The SAP Business Partnership Study shows that three out of four small and midsize enterprises (SMEs) see IT and technology vendors not just as an external resource but as vital to their business. More and more technology vendors are being used by business leaders for consultation (76 percent), for insight and advice (79 percent) and to anticipate...

Credit Risk & Scoring

Dec 20, 2017

Twenty-four percent of UK SMEs believe that banks have failed to change the way they behave since the global financial crisis in 2008. The survey of UK SMEs from CivilisedBank, the new UK business bank with a Local Banker network, also reveals that over half (55%) of those surveyed believe that it is not a priority for banks to act in a ‘civilised...

Gender Finance

Policy & Regulation

Sep 25, 2013

The historical data documents the evolution of gender parity in property rights and legal capacity in 100 economies from 1960 to 2010. It provides 14 indicators covering property ownership, marital regimes, inheritance, property titling, legal status and capacity, constitutional rights of equality and non-discrimination and the treatment of legal...