Our events

SME Finance Virtual Marketplace - March Pitch Session

The SME Finance Virtual Marketplace, an initiative of SME Finance Forum, powered by IFC, is an online match-making platform that fosters collaboration between financial institutions, fintech companies, development finance institutions and investors.

The aim? To drive impactful partnerships and innovations in the SME finance landscape.

This monthly pitch session, scheduled on Wednesday, March 27th from 8 am to 9 am EST, will feature Leading Small Business Lenders and SME growth Facilitators who will present their MSMEs Product and Services.

WHY YOU SHOULD JOIN?

-

You are missing a tool in your fintech stack to accelerate your digital transformation and want to discover new products.

-

You are looking to invest in impactful fintech companies that help SME grow.

-

You are in search of new clients and investors for your innovative financing solutions.

Companies pitching

Mastercard - Global reach

Mastercard is a technology company in the global payments industry that connects consumers, financial institutions, merchants, governments, digital partners and businesses, enabling them to use electronic forms of payment. Our knowhow provides insights into understanding digital economies and payment ecosystems. Mastercard is present in 210 countries and territories around the world and operates one of the world’s fastest payment processing networks.

InsightGenie - Singapore

InsightGenie specializes in financial inclusion through the utilization of alternative data and behavioral science for credit risk assessment. Their distinctive capability lies in generating self-data through voice, video analytics, and digital footprints to forecast loan default probabilities, as well as applying these insights in HR and recruitment contexts.

Boost Capital - Singapore, the Philippines, Cambodia, and India

Boost is an award-winning, white-labeled SAAS platform that allows Banks to onboard customers via popular chat platforms such as Facebook Messenger, Telegram, & Whatsapp through smartphones, fast and without an app download. Boost offers the best possible funnel for new customers to apply for loans, credit cards, savings, and insurance products and can enable applications on 100% of the smartphones in each market. Boost has enabled over 2m applications through our partners.

Proparco - Global reach

The French DFI Proparco provides funding and support to businesses and financial institutions in Africa, Asia, Latin America and the Middle-East. Its action focuses on the key development sectors and aims to strengthen the contribution of private players to the achievement of the Sustainable Development Goals adopted by the international community”.

10x1000 Tech for Inclusion - Global reach

10x1000 Tech for Inclusion is a philanthropic initiative created by Ant Group and the International Finance Corporation (IFC). Its primary goal is to inspire and nurture at least 1,000 future digital leaders every year for the next ten years. Since its launch in 2018, 10x1000 has become a global community of nearly 10,000 individuals and institutional partners from over 100 countries and regions. The community is dedicated to sharing experiences, exchanging ideas, and finding solutions for digital innovation.

Tetmon - Singapore, the Philippines, UK, and Malaysia

Tetmon does data plumbing/ integration, so that AI can happen. Headquartered in Singapore, our international clientele include entities in Kuala Lumpur, London, Manila, and Singapore. Our co-founders each have 20 years of experience in the technology/ data space, graduated from the likes of Oxford University, and previously worked for GIC, Rocket Internet, etc. CSR wise, we volunteer with 10x1000, a global philanthropic financial inclusion initiative by International Finance Corporation (IFC) and Ant Financial.

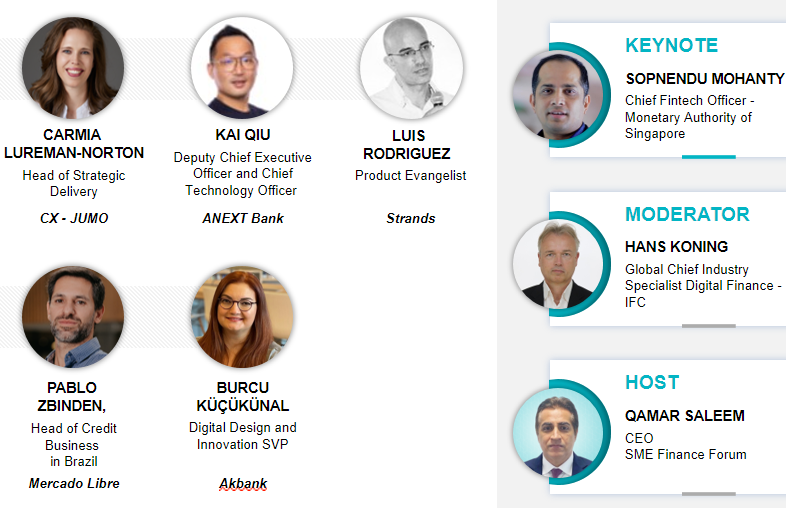

Speakers

Nicolas Ingaramo - Global Lead SME Distribution and Enablement - Mastercard

Nicolas Ingaramo leads Global SME Distribution and Enablement at Mastercard. In this role, he is responsible for leading the SME value proposition and go-to-market strategy with nontraditional issuers (Neobanks, CPGs, Fintechs, within others), He is also responsible for the SME wave for Start Path (Mastercard’s award winning startup engagement program) with the mission to bring innovation to Mastercard’s core business.

Nicolas was previously with Mastercard Argentina, where he was Director in Account Management. In that role, he led fintech and global accounts including HSBC, Nubank, Itau, and several regional accounts. Amongst other achievements, Nicolas played a key role in the transformation of the Contactless implementation in Argentina, supported the largest bike-sharing system in LAC, and was part of the launch of MODO.

Nicolas brings over 15 years of payments and industry experience in a variety of roles including JPMorgan FX and Derivatives, Prisma Medios de Pagos and in PwC as a strategy consultant.

Vincent Choy - Co-Founder and Chief Business Development Officer - Bizbaz (InsightGenie)

Experienced working in over 35 countries, specializing in market access, strategy, capital advisory and business development mainly in startups. Worked across oil & gas, renewables, green financing, blockchain and fintech industries.

Yann Jacquemin - Deputy Head of the Financial Institutions Debt and Guarantee Group - Proparco

Mr. Yann Jacquemin serves as deputy head of the Financial Institutions Debt and Guarantee Group, covering the worldwide medium and small enterprises guarantee program (“Ariz”) provided by Proparco, in Paris. Previously, Mr. Jacquemin hold different positions within PROPARCO and AFD, overseas and at the headquarters. He worked previously in Société Générale CIB Paris (France) and New York (NY, USA), both on operations and project manager. Mr. Jacquemin holds a Master Degree in Finance from Lyon 2 University (Lumière).

Gordon Peters, Co-founder and CEO - Boost Capital

As Co-Founder of Boost Capital, Gordon leads the team to create innovative technology to expand access to digital financial services for the un(der)banked.

Boost is a white-labeled tech platform that allows Banks to onboard clients in minutes without an app download… totally through chat-based platforms like Whatsapp, Telegram, and Facebook Messenger. Previously, Gordon led M&A transactions in Banking and Microfinance across Southeast Asia as a Partner at Mekong Strategic Partners. Gordon previously was the Managing Director at Emerging Markets Consulting - expanding the business to operate in Singapore, the Philippines, Indonesia, Thailand, Vietnam, Myanmar and Cambodia. Gordon also co-founded SocialCash, a leading ad network on Facebook and Twitter - which was acquired by Lifestreet Media. Gordon started his career at Bain & Company.

Dongye YANG, - Senior Director, Strategy Development, Ant International - Head of Partnerships and Operations, 10x1000 Tech for Inclusion

Dongye is a seasoned professional with extensive experience in partnership development and strategic marketing. He joined Ant Group in 2020 and has been appointed as the Head of Partnerships and Operations for 10x1000 Tech for Inclusion, a philanthropic initiative launched by Ant Group and the IFC. The initiative aims to inspire and develop tech leaders and digital talents worldwide.

Dongye has previously held the position of Executive Director of Strategic Partnerships at Fosun Group, a China-based conglomerate with a strong global presence. Prior to that, he has worked in product strategy and marketing roles for financial institutions including Bank of Montreal, Royal Bank of Canada, and Mastercard.

Dongye completed his MBA degree at the Rotman School of Management at the University of Toronto, Canada, in 2016. He also holds a Master's Degree in Project Management from the University of Warwick and a Bachelor's Degree in Marketing from the University of Liverpool.

Yinghan started his career at GIC before holding management and roles at government-linked corporations. He currently

How does the Marketplace operate?

To participate in the marketplace, each institution must have:

- An institutional profile (company profile and products/services offering)

- A personal profile (individuals representing the companies)

Individuals on the Marketplace can explore products and services available (investment products, advisory services, technology solutions...etc. ) and reach out to one another to discuss potential collaboration and partnership.

IFC does not endorse any products featured on the virtual platform or endorse any views expressed by the companies featured on the platform. IFC shall have no responsibility or liability for any party’s reliance on the products or views of any company featured on the site.