Blog

Banco de Oro's Vision on SME Banking in the Philippines

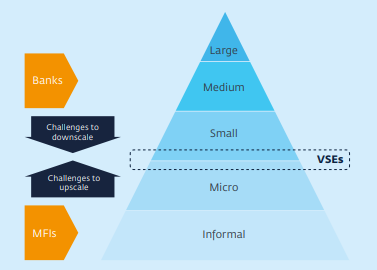

Small enterprises account for more than 90 percent of the Philippines economy. However, a study done by the International Finance Corporation (IFC) said that funding obtained by the SMEs in the Philippines from formal financial institutions account for only between 12 to 21 percent of their total current funding. What are the reasons behind this?

Nestor Tan : SMEs generally rely on informal sources rather than bank financing for the following reason:

- Cumbersome documentary requirements for loan applications, such as proof of capacity to pay and other legal documents including income tax returns, audited financial statements, and business permits.

- SMEs seem to be intimidated by banks and traditional bankers due to a variety of reasons: the lack of acceptable collateral that they could present to banks, the absence of accounting or business systems or their unfamiliarity with bank requirements.

- Limited accessibility of banks to SMEs as the latter are mostly located in areas far from where banks are.

What can banks do to better meet the financing needs of SMEs?

Nestor Tan: Commercial banks have taken initiatives to better meet the financing needs of SMEs. These include creating innovative products to fit SME requirements, easier loan application processes through non-traditional channels (e.g., online application), expanding the branch network and conducting SME forums to reach more SMEs, and active participation in wholesale funding facilities provided by government financial institutions and donor funds.

Banks will also have to learn to develop proxies for audited financial statements to be able to validate the SME’s capability to repay its loans. To address the issue of risks posed by SMEs, some banks have developed SME credit scoring models for better credit risk management. Banks need to reach out to SMEs directly instead of waiting for SMEs to come to them.

What are some examples of strategies or financial products you have introduced at Banco De Oro Universal Bank to cater to SMEs?

Nestor Tan: Some examples of products we have introduced to cater to SMEs include:

- Specific loan products like the BDO Small Business Loan which is a short-/medium-term loan facility that addresses entrepreneurs’ financing needs for additional working capital, business expansion, diversification (new products or business), and reimbursement/refinancing purposes.

- SME packages such as cash management and collection services that the Bank puts together for clients, thus sparing them the inconvenience of having to buy the Bank’s products/services on a piecemeal basis.

- Leasing and financing solutions offered through the Bank’s subsidiary, BDO Leasing. Leasing offers clients an alternative to grow their business with minimal capital outlay, thus conserving their working capital while preserving their existing credit lines. Lower cash out, higher amount financed, and tax-timing benefits are the other advantages of leasing.

Examples of strategies we have introduced to cater to SMEs include:

- Using a credit evaluation process that recognizes secondary information sources such as channel checks and deposit transactions as proxies for revenues and cash flow to determine capacity to pay.

- Reaching out and going to the SME market in a non-threatening way:

The Bank conducts its “Grow Your Business with BDO” SME Forums to better understand SME clients and their business and at the same time create a venue for SMEs to know more about BDO and its products. This has not only strengthened bank-customer relationships but also created an opportunity to access emerging business opportunities in high-growth provincial areas and the underserved market.

The Bank’s SME Forums are led by the BDO President together with Senior Officers who present customized solutions best suited to clients’ needs. As well, the Bank’s market strategist updates clients on current economic developments as these impact their business, while guest experts share relevant management, business and financial insights.

When it comes to financing SMEs, what are the main differences in the lending practices of commercial banks versus thrift and rural banks?

Nestor Tan: Given their business model, thrift and rural banks are located in provincial and rural areas that make them more accessible to, familiar with, and knowledgeable about SMEs. If done right, the closeness to the market by rural banks leads to better credit decisions.

In contrast, commercial banks are located in the cities and metropolis given their orientation towards large corporate and retail lending. The inadequacy or the lack of credit information regarding SMEs result in more time allocated by commercial banks to thoroughly validate financial statements and collaterals presented by these enterprises, resulting in longer processing time for SME loan applications.

A recent survey released by USAID shows that only 26.56 % of Filipinos aged 15 years old and above have accounts with banks or other financial institutions. Why should we be hopeful about the future?

Nestor Tan: The low bank penetration should be viewed in terms of the potential it brings for the banking industry and for the growth of the economy.

For the banking industry, this means greater scope to widen its reach to cover the unbanked and underserved markets, and tap the opportunities with these markets. This may be done not only through the traditional bricks-and-mortar, but also through alternative and non-traditional channels (e.g., electronic and mobile banking). Technology should play the role of an enabler, by which IT upgrades and innovation increase banks’ capability to broaden their coverage and reach remote areas.

For the economy, this translates to enhanced prospects for inclusive growth as small businesses in remote areas are brought into the mainstream and are able to enjoy the advantages of formalized enterprises.

If developed properly, SMEs can insulate us from the impact of globalization and big business, given their entrepreneurial nature and domestic market orientation.