External Resources

Policy & Regulation

Credit Risk & Scoring

Payments

May 29, 2019

New analysis provides a glimpse of the future as countries like China pave the way for a whole new system of banking. China is seeing an “explosive growth of mobile payments. With a record $12.8 trillion in mobile payment transactions from January – October 2017, China far surpasses the U.S. at only $49.3 billion,” according to data. Dana Nino, an...

Non Financial Services

Policy & Regulation

Payments

May 24, 2019

The Future of Business survey is a collaboration between Facebook, the OECD and the World Bank to provide timely insights on the perceptions, challenges, and outlook of online Small and Medium Enterprises (SMEs). The Future of Business survey was first launched as a monthly survey in 17 countries in February 2016 and expanded to 42 countries in...

Non Financial Services

Rural & Agriculture Finance

Apr 19, 2019

Agrifrance*, a specialist division of BNP Paribas Wealth Management (a SME Finance Forum member), has published its special report on France’s rural land market, this year comparing it with the market in Britain. The main findings of the report: Agricultural land in the United Kingdom occupies 17.3 million hectares, versus 26 million hectares in...

Supply & Value Chain Finance

Credit Risk & Scoring

Digital Transformation

Apr 03, 2019

According to a survey of 2000 directors at UK SMEs, almost half of UK SMEs (49%) would seek financing from non-bank lenders as they begin to better understand the business models of companies in this space, including fintechs. A Leeds-based fintech known as Rebuilding Society, founder Dan Rajkumar, recently said: “When you are a business and you...

Alternative Financing

Gender Finance

Feb 04, 2019

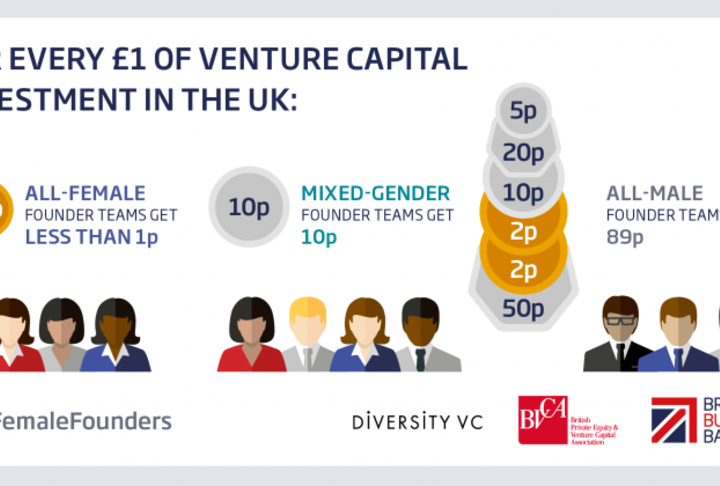

Female start-up founders are missing out on billions of pounds of investment, new research published today finds. The UK VC & Female Founders report found that for every £1 of venture capital (VC) investment in the UK, all-female founder teams get less than 1p. By comparison, all-male founder teams get 89p and mixed-gender teams get the...

Financial Education

Non Financial Services

Jan 30, 2019

Private sector small business employment increased by 63,000 jobs from December to January according to the January ADP Small Business Report. Due to the important contribution that small businesses make to economic growth, employment data that are specific to businesses with 49 or fewer employees is reported each month and broadly distributed to...

Financial Education

Non Financial Services

Governance

Jan 29, 2019

There are two views of the EGM. The first view ‘Digital Finance Studies’ shows the total number of studies that were conducted on a particular product, plotted against the client outcomes which were tested. The objective with this view is to give the user an overview of the impact literature on digital finance and highlight which digital finance...

Equity

Gender Finance

Fintech

Jan 02, 2019

A new study seen exclusively by Yahoo Finance UK shows how difficult it is for women in Britain, compared to men, to start their own business. Yahoo says, men are three times more likely than women to have over £250,000 ($320,479) of investible assets – essential capital for getting a business started – according to private equity house IW Capital...

Gender Finance

Supply & Value Chain Finance

Dec 31, 2018

A study by Calvert Impact Capital found that diversity in senior staff had a greater impact than the number of female directors or the gender of its founder. “We saw a particularly strong relationship to women in leadership,” said Leigh Moran, Calvert’s director of strategy. “We think there’s a common misconception that incorporating gender is...

Financial Education

Non Financial Services

Gender Finance

Dec 05, 2018

This booklet presents a compilation of frequently used graphs on entrepreneurship trends and SME performance drawn from the OECD Statistics and Data Directorate’s databases of Structural and Demographic Business Statistics (SDBS), Timely Indicators of Entrepreneurship (TIE), Trade by Enterprise Characteristics (TEC), Entrepreneurship Finance...

Financial Education

Supply & Value Chain Finance

Nov 01, 2018

TUHF's Integrated Annual Report is used to communicate with their stakeholders, primarily their funders and They use it to explain their performance, strategy and prospects, and compiled it according to International Integrated Reporting Council’s (IIRC) Integrated Reporting <IR> Framework. This report covers the performance of the Trust for...

Non Financial Services

Gender Finance

Supply & Value Chain Finance

Oct 18, 2018

The International Monetary Fund (IMF) released the 2018 Financial Access Survey. The survey includes information from 189 countries spanning over 10 years. Key findings in the report include: Highlighting the use of retail agent outlets, mobile money growth, and progress in women’s financial inclusion. According to data from the report, financial...

Financial Education

Non Financial Services

Sustainable Finance

Policy & Regulation

Oct 05, 2018

Medici examines the widening financial gap in India and their lack of push for institutional credit for consumers. With consumer debt to GDP at only 17 percent, India falls behind major economies of Asia Pacific. According to the article, “In the absence of institutional credit at fair interest rates for a majority of the population, people at the...

Non Financial Services

Policy & Regulation

Credit Risk & Scoring

Aug 20, 2018

A survey conducted by the BDRC between Sept. 2017 and June 2018 revealed the quality of service provided by banks from SME business account customers. SMEs were asked to give feedback in the following areas for their respective bank: Overall service quality Online and mobile banking services Services in branches and banking centers SME overdraft...

Gender Finance

Supply & Value Chain Finance

Aug 13, 2018

Women in the Western Cape are dominating the SME industry. According to the article, “women-owned businesses experienced 50 percent more growth than businesses owned by men in the Western Cape.” This boost can be contributed to women making smarter investment decisions, according to a survey conducted by Retail Capital. Key points revealed in the...

Non Financial Services

Gender Finance

Policy & Regulation

Jul 17, 2018

This report is based on information gathered in the GBA’s Women’s Market Analytics Survey — the only collection of global banking data measuring the performance of financial institutions serving the Women’s Market, with four years of performance data and over 400 data points per institution. This second edition of the report bears out several...

Non Financial Services

Supply & Value Chain Finance

Credit Risk & Scoring

Jul 13, 2018

A study by Fachhochschule des Mittelstands (FHM), the SME University in Bielefeld, revealed that the demands placed on finance and liquidity management have increased, leading to the proliferation and professionalization of cash management systems. In the study, 280 SME finance managers were surveyed and when compared to previous studies there is...

Gender Finance

Payments

Jul 09, 2018

BuyUcoin, an Indian cryptocurrency exchange, has found that female Indian investors, on average, invested over Rs1.4 lakh (around $2,000) on digital currencies—twice the amount that men typically spent. The survey, conducted between March and June, had over 60,000 respondents.

Non Financial Services

Equity

Guarantees

Jul 05, 2018

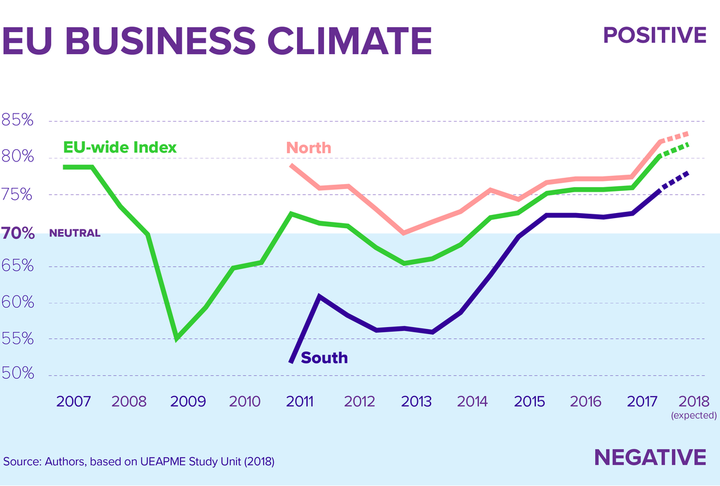

This analysis provides an overview of the main markets relevant to the EIF. It starts by discussing the general market environment, then looks at the main aspects of equity finance and the guarantee and SME securitisation markets and, finally, it highlights important aspects of microfinance in Europe. A chapter on Fintech also complements the...

Credit Risk & Scoring

May 30, 2018

Digital credit offers enormous promise to enhance provide a valued service to the mass market thus increasing financial inclusion, while also driving uptake and use of digitial financial services (DFS). However, with 2.7 million people already blacklisted on the credit reference bureau in Kenya, concerns are growing about current standards of...