Blog

How SME Credit Rating can Unlock Financing for Small Businesses

A recap of “SME Credit Rating Webinar"

During a recent webinar, industry experts from the IFC, Cambridge Center for Alternative Finance, Experian, and Inbonis, discussed some of the challenges in lending to SMEs and how SME credit rating can mitigate the risk of lending to smaller firms.

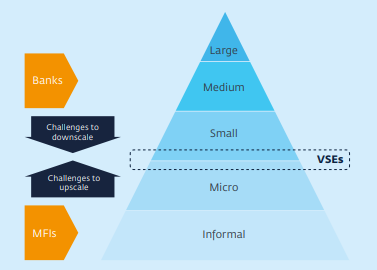

Shalini Sankaranarayanan, a Senior Financial Sector Specialist with the Credit Infrastructures team under the Finance, Competitiveness and Innovation (FCI) Global Practice at the World Bank Group, provided an overview of SME credit rating and some of the challenges in rating this segment of the market. Generally, SME is a large heterogenous term with no common definition and this makes it difficult to have a standard SME credit rating. Further, different SMEs have different needs, different data footprints and need different solutions, making it difficult to rate these small businesses.

However, many new players are trying to fill the gap in assessing risk of financing SME. To mention a few there are bureaus (consumer and commercial), ratings agencies, fintechs, data analytics providers, and alternative scoring providers. What makes this possible, is growth in AI and machine learning, allowing for new data extraction, making more data available for rating SMEs to a wider audience.

Tania Ziegler, the Head of Global Benchmarking at the Cambridge Centre for Alternative Finance, Cambridge Judge Business School, also shared some early results from the 2019 Global Benchmark in regard to SMEs access to finance. She gave some background on global alternative finance and on innovations pursued by fintech firms, which support increased lending to SMEs, including credit data and scoring, banking APIs, and emerging technologies.

Experian, a member of the SME Finance Forum, has 12 business credit bureaus globally. The large, global firm shared some of their developments in technology and big data, and analytics. Now, some of the tools and services they have deployed in their consumer and retail market can be scaled into the SME space. James Gothard, General Manager of Credit Services & Strategy, South East Asia at Experian, shared some of the Experian’s key enablers to driving automation and efficiency in lending to SMEs, including utilizing traditional data like credit bureaus. However, increasingly big data, and more advanced data like ecommerce, payment, and other alternative data are important. Salil Chugh, the Head of Analytics & Data Partnerships, Asia Pacific at Experian, shared one example of their innovation in this space. The SME Network Score combines traditional data with alternative data and machine learning, to understand how SMEs interact with one another in order to predict how an SME will repay if they’re giving a loan.

Inbonis, another member of the SME Finance Forum, is a fintech focused on this issue and it is the first credit rating agency specialized in SMEs in Europe. They are focused on the idea of democratizing credit ratings, so SMEs can access a variety of funding sources. In their experience, SME credit rating can be used by several players, including the SMEs themselves to monitor their performance, and by a number of funding including the public sector, banks and alternative financiers.

The speakers highlighted that, although SMEs are one of the most difficult segments to rate, access to both traditional and new data can help to rate this varied segment of small businesses. With access to different types of data, there are several new types of SME credit ratings that can both alleviate some of the information asymmetry that have made it difficult for SMEs to access traditional lending and help SMEs access alternative finance and measure their own performance.

If you are a member of the SME Finance Forum, you can view the video of the recent webinar here, signing in to our Member Portal.