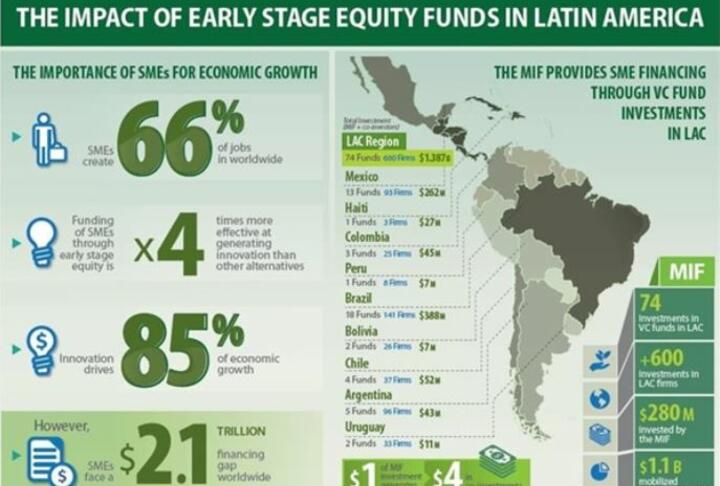

Startups and scaleups create the vast majority of jobs in the formal economy, providing, on average, 66% of the jobs worldwide, and the greatest share of jobs in low income countries. Moreover, the small and medium enterprise (SME) sector is important not just for job creation, but also for economic growth, thanks to its outstanding capacity to increase productivity through innovation. For example, approximately 85% of growth between 1900 and 1950 is attributable to innovation, rather than increased usage of inputs, and the financing of SMEs via risk capital —most notably venture capital, which is also called smart capital because it combines financing with active hands-on support— has been found to be three to four times more effective at generating innovation than other alternatives, such as corporate research or development funding.

However, young companies with not fully proven business models, or those who haven’t reached break even, often have difficulty accessing funding: it is estimated that they face a financing gap over $2.1 trillion worldwide, and that bank loans to SMEs only represent 3% of GDP in emerging markets.