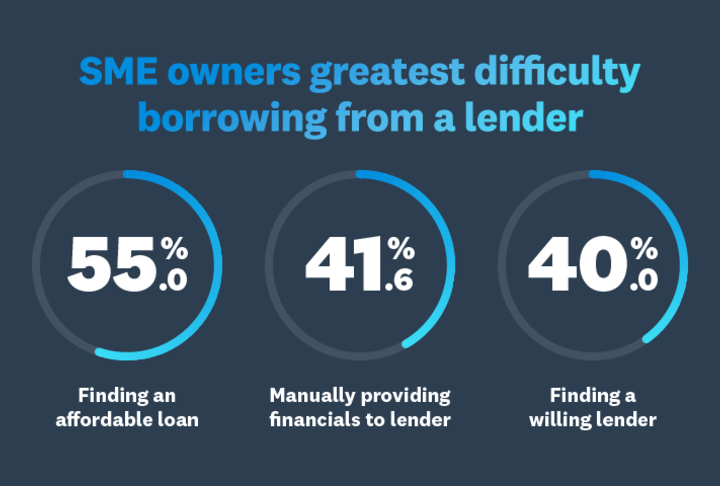

Research from SME Finance Forum member Xero revealed, that SMEs in Australia would borrow $80 billion over the next year, if funding was available. According to the research, SMEs reasoning for difficulty borrowing from a lender include:

- 55 percent finding an affordable loan

- 41 percent manually providing financials to a lender

- 40 percent finding a willing lender

The Xero State of Lending report showed, one in five small business owners stating access to capital as the greatest hurdle or perceived threat for long-term growth aspirations.

A May report from the Ombudsman revealed, “Small and medium enterprises need to work with their bookkeepers, accountants and trusted advisers to prepare the business for lending. Demonstrating their creditworthiness, having current business plans, cash flow forecast, demonstrable profitability, and a track record of paying bills on time.”